Process Improvement

Financial Stability

All companies tend to rely on "the numbers" to determine success. Unfortunately the components that make up company finances don't necessarily end with Liabilities, Assets, and Expense. Human capital, optimized infrastructure, and use of technology play a critical role in financial stability. Traditional business documents include:

- Profit and loss statement (income) defines revenue and expenses in a determined period P&L

- Balance Sheet demonstrates the relationship between assets, liabilities, and ownership equity as of a particular date

- Cash Flow relates operating results with short-term ability to pay on debts (generally)

- Bank Statements identifying all summarized transactions for a period of time reconciled between the company and a financial institution

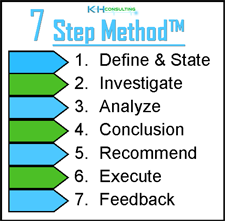

Companies that make business decisions on financial change tend to focus on short-term goals rather than long-term objectives. Advantages found in technology change, employee training, process improvement, or marketing plans are simply not addressed. Business owners who explore benefits of other areas of influence including sales and marketing, operational change, vendor relationships, product diversification, and security of intellectual property develop stronger core capabilities and competitive advantage. Using our diagnostic approach can be the first step to realizing this potential.